j-51 tax abatement phase out

The exemption will last for a period of fourteen years with 100. Web J-51 is a property tax exemption and abatement for renovating a residential apartment building.

New York Allows J 51 Tax Exemption For Buildings To Expire

The J-51 tax incentive is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings.

. 30-years full 4-years phase out or. Web J-51 Tax Abatement and Exemptions Webmeh 2021-07-08T1840190000. Web Tax Abatements OSC Report.

Web Municipal Tax Abatement Toolkit. The benefit varies depending on the buildings location and the type of. Web J-51 Tax Abatement Phase Out.

The exemption will last for a period of fourteen years with 100 exemption for ten years. Web The first phase of construction includes a seven-story mixed-use building with 9000 square feet of retail on the ground floor and a 136-room hotel on the upper floors. Web subsequently receive J-51 or 421-a benefits.

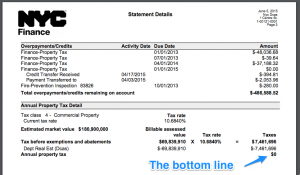

Web In other words the J 51 program comes to an end whenever the total amount of the J-51 lifetime abatement is exhausted or the maximum 20-year time limit ends. With 100 exemption for ten years followed by a 20 phase-out in each of the succeeding four years. Web The post-construction tax benefits phase out over time based on a set schedule and the property becomes fully taxable upon expiration of the abatement.

Web To apply follow instructions on Form EOZ-1 and file with your tax assessor. Web The J-51 tax abatement program was implemented in 1955 as a way to encourage building owners to install hot water plumbing in their properties. The j51 tax incentive program is.

The benefit varies depending on the buildings location and the type of improvements. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are. If a building owner receives a J-51 tax abatement for an item that DHCR has issued an MCI rent increase order the rent is.

The J-51 abatement is just a. Handbook for New Jersey Assessors Chapter Four New Jersey Property Tax Benefits. The J51 tax incentive program is designed for renovations and conversions on existing residential buildings.

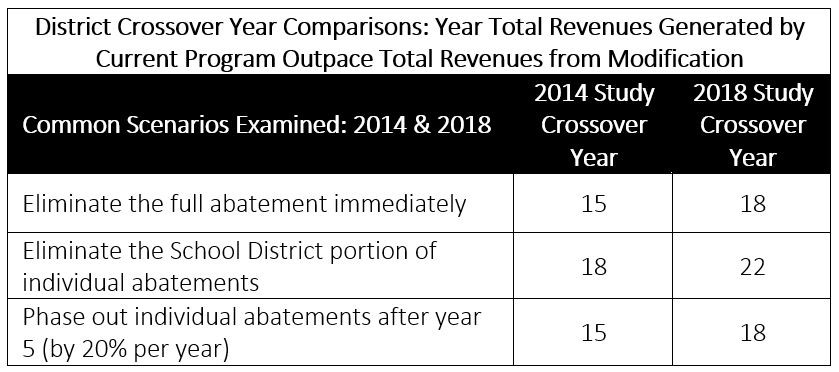

This report is crucial reading for municipal officials evaluating potential tax abatements. This excellent guide summarizes the law and draws. Web Find Out If Your Property Is Eligible.

What Are The Tax Abatements For Coops And Condos In Nyc

City Releases Study Of 10 Year Property Tax Abatement Department Of Revenue City Of Philadelphia

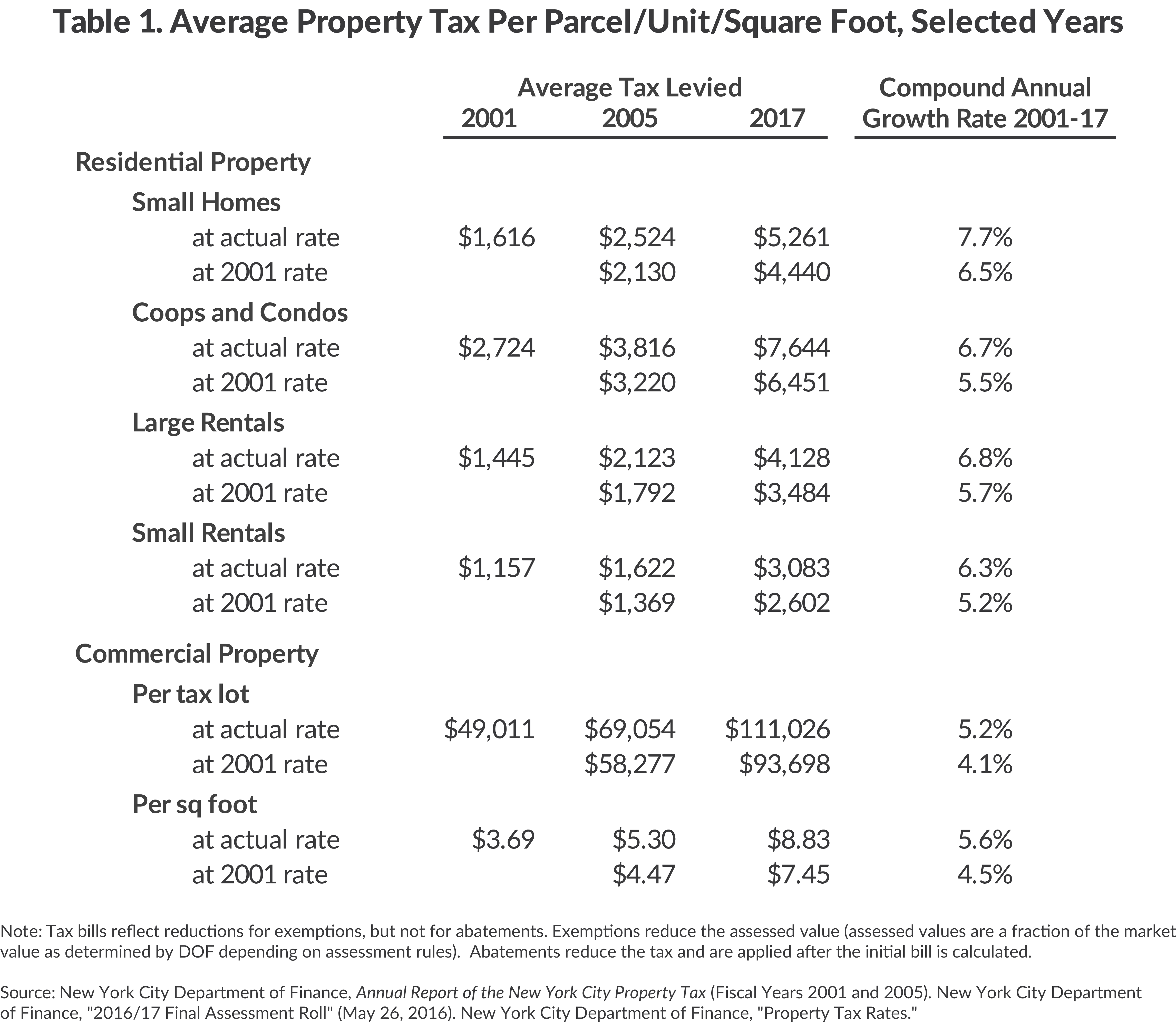

New York City Property Taxes Cbcny

J 51 Tax Abatement In Nyc History Benefits Drawback And More

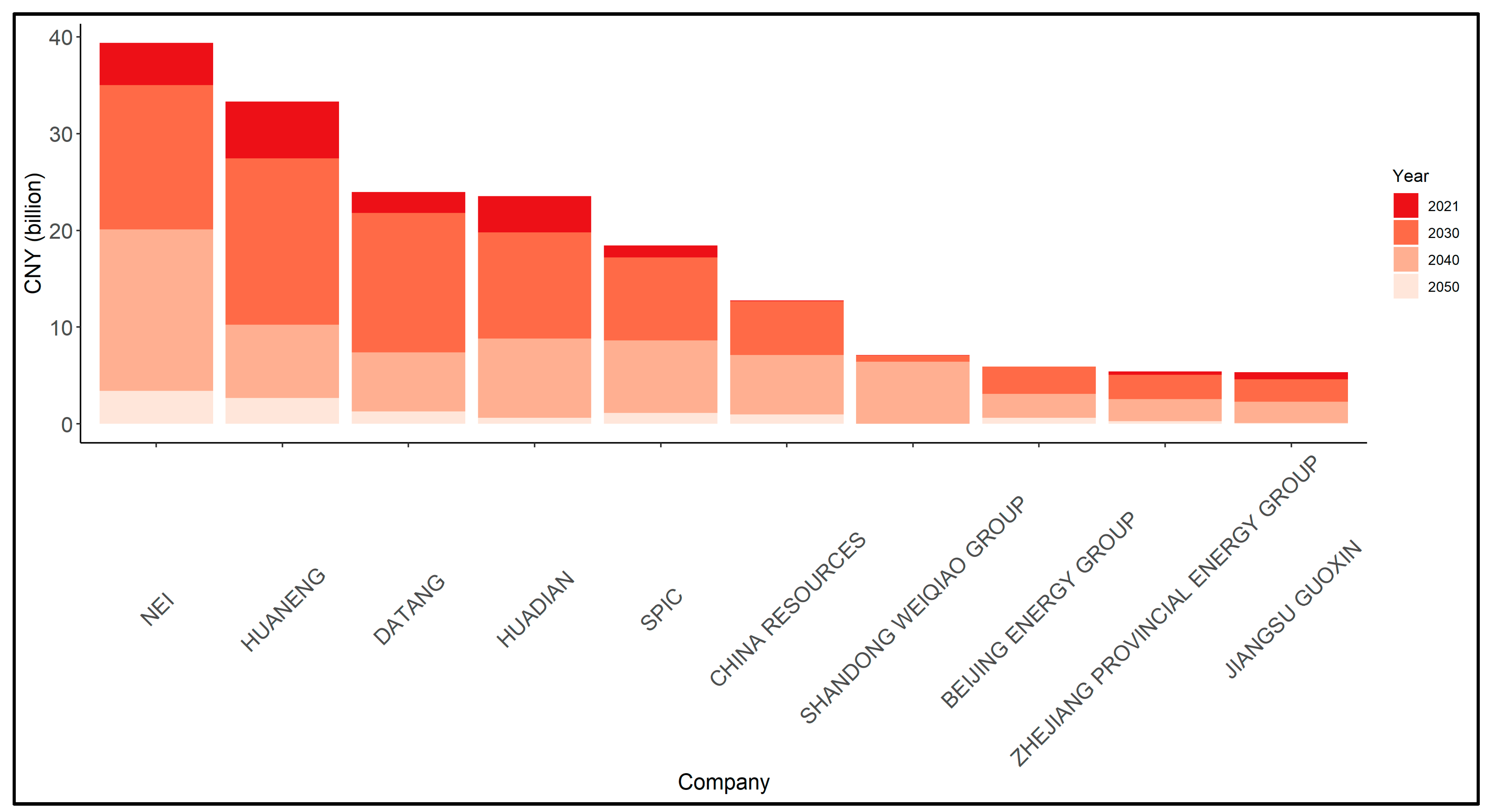

Energies Free Full Text Estimating The Employment And Fiscal Consequences Of Thermal Coal Phase Out In China

Benefits Of A Historic District Morningside Heights Historic District Council

What Tax Benefits For Investment Properties In Nyc Nestapple

Buying An Apartment With A J 51 Tax Abatement In Nyc Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

J 51 Metropolitan Realty Exemptions

New York Allows J 51 Tax Exemption For Buildings To Expire

Buying An Apartment With A J 51 Tax Abatement Hauseit

City Council To Revive J 51 Tax Break For Apartment Buildings

J 51 Metropolitan Realty Exemptions

Co Op And Condo Advocates Push For J 51 Tax Break Renewal Habitat Magazine New York S Co Op And Condo Community

A Guide To Tax Benefits For Investment Properties In Nyc Elika

Buying An Apartment With A J 51 Tax Abatement Hauseit

Nyc Tax Abatements Guide 421a J 51 And More Prevu

City Council Approves Queens Lawmaker S Bill Extending The J 51 Property Tax Exemption And Abatement Program Qns Com